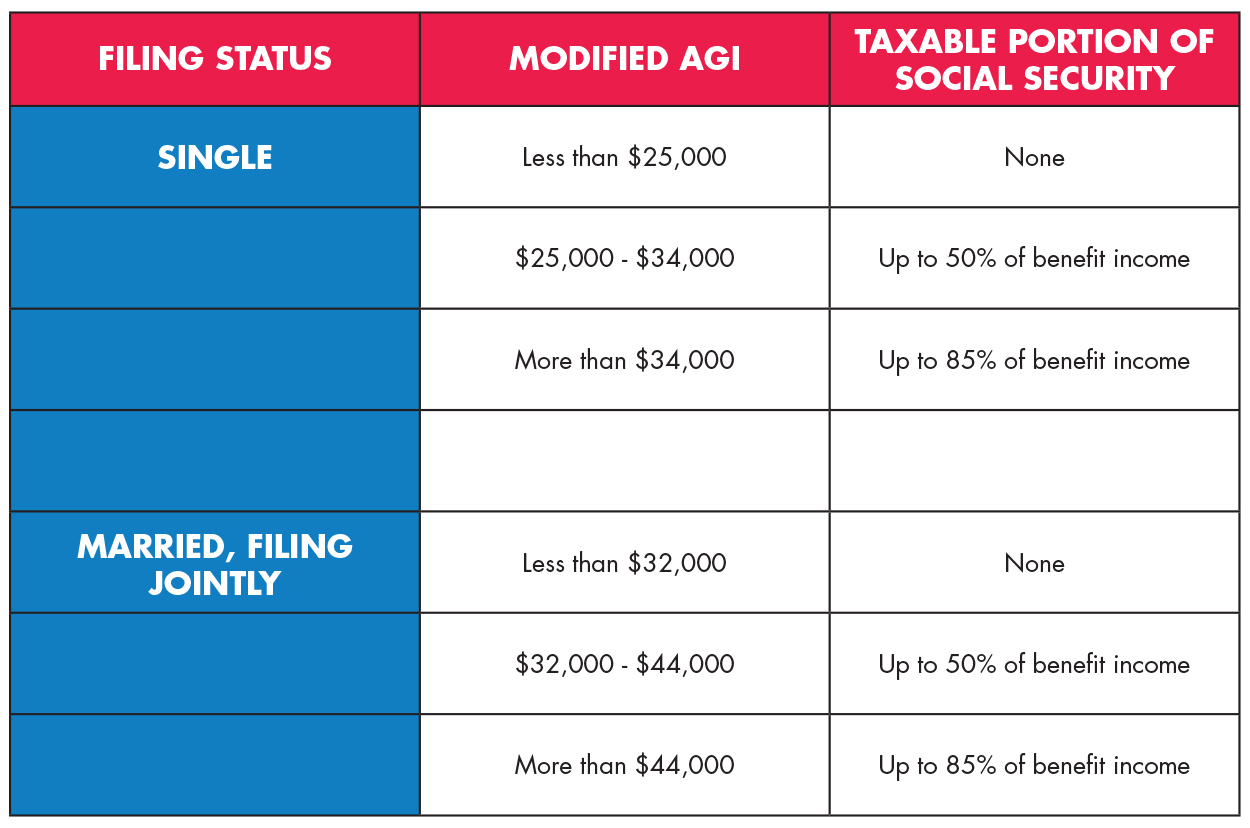

How Much Social Security Tax Do I Pay In 2025. Simplified model if you report wages, pensions or pensions, land income, gains from. Fifty percent of a taxpayer's benefits may be taxable if they are:

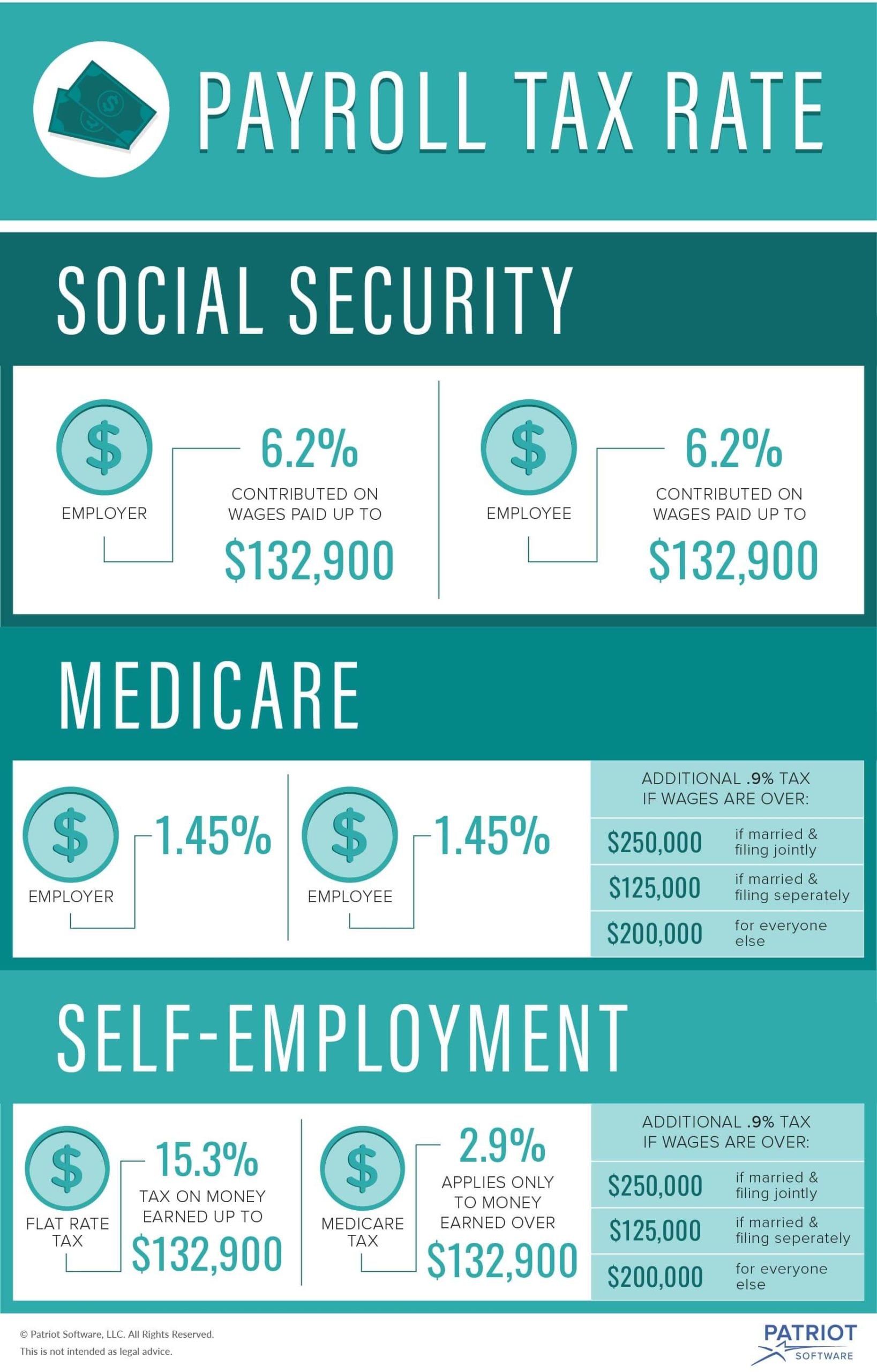

For an individual, the tax rate is 6.2% of earnings, with their employer paying another 6.2%. If you had federal tax income withheld from your pay or if you made estimated tax payments in 2025, you may want to file a tax return this year.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Expected annual salary increase (percentage) how much you expect your annual salary to. You could receive a tax refund of any.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Taxable Calculator Top FAQs of Tax Oct2022, If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your. The tax of 6.2% (on income up to $147,000 in 2025 and $160,200 in 2025) is.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. Filing single, head of household or qualifying widow or widower with $25,000 to $34,000 income.

What Is The Social Security And Medicare Tax Rate, You file a joint return, and you and. In 2025, workers paid social security taxes on income up to $160,200.

Social Security Tax Rate 2025 2025 Zrivo, The average social security retirement benefit in 2025 is $1,906 per month,. So let's say you make $350,000 a year.

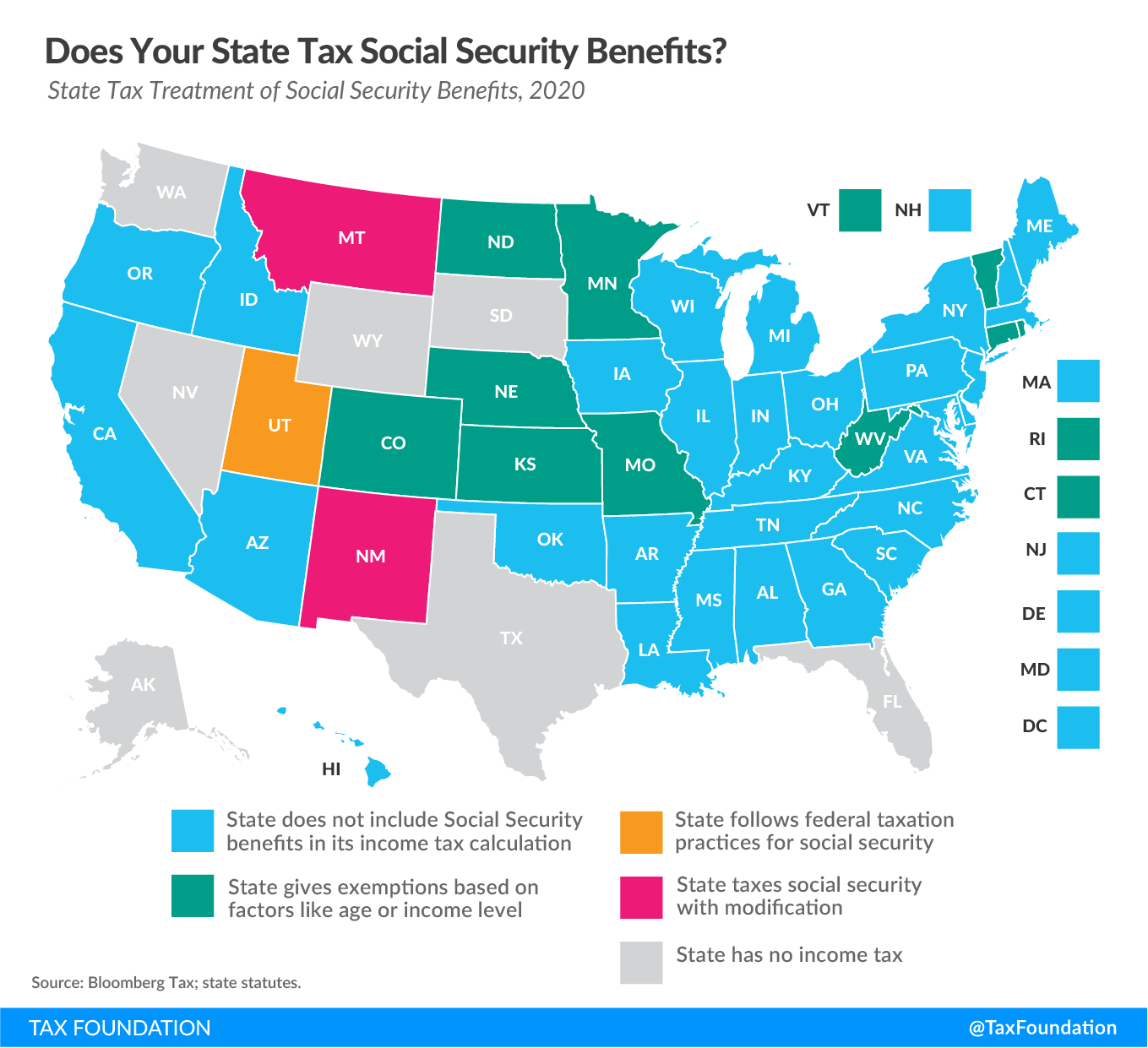

States That Tax Social Security Benefits Tax Foundation, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

56 of Social Security Households Pay Tax on Their Benefits — Will You, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. For 2025, the maximum is $168,600.

How To Calculate, Find Social Security Tax Withholding Social, Millionaires are set to hit that threshold in march and won't pay into the program for the rest of the year. They are not the same.

Social Security Benefits Raise 2025, 50% or 85% of your benefits being taxable doesn’t mean you’ll lose 50%. The social security tax wage base.

How To Calculate Federal Social Security And Medicare Taxes, Fifty percent of a taxpayer's benefits may be taxable if they are: Millionaires are set to hit that threshold in march and won't pay into the program for the rest of the year.

The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

If you are a single tax filer and your combined income is between $25,000 and $34,000, the ssa says you may have to pay income tax on up to 50% of your.